Sometimes referred to as the “Jewel of the Blue Ridge” or “Lake Tahoe of the East”, Smith Mountain Lake also known simply as “SML” is tucked among the Blue Ridge Mountains of peaks reaching elevations of 4,000 feet. Smith Mountain Lake is recognized for its clear waters, beautiful communities, endless recreational activities, spectacular views, and temperate climate.

Dam under construction as Smith Mountain Gap

A little about Smith Mountain lake

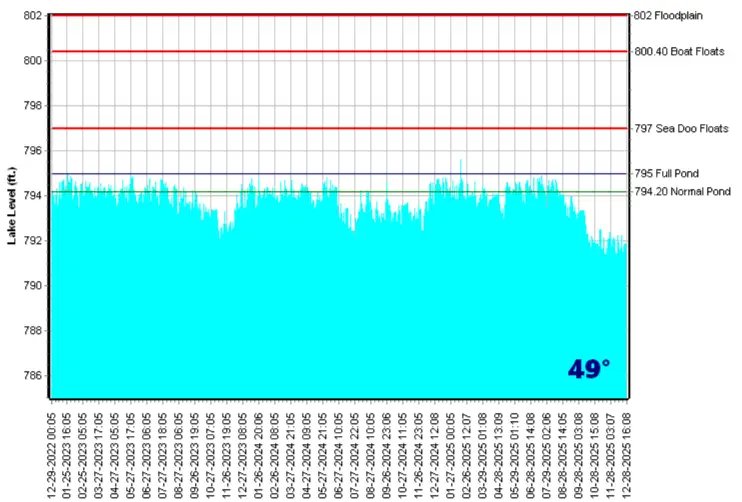

Created by the damming of three rivers and numerous creeks, SML remains one of the East Coast’s hidden treasures. SML is approximately 40 miles long end to end with over 500 miles of shoreline. The 22,000 plus acre lake is expansive and offers a large variety of recreational activities and real estate opportunities to address just about everyone’s needs. Construction of the dam began in 1960 at Smith Mountain Gap as a hydroelectric project to create electricity as part of Appalachian Power’s system. The dam was complete by 1963 and the lake reached its full level in early 1966. As water is released through the dam, as much as 605,000 kilowatts of electricity is generated. At night when surrounding power plants have excess power, water can be pumped back into the lake from the lower lake, Leesville Lake. Lake levels are well managed throughout the year.

Shoreline Management

Appalachian Power is the operator of the lake through their license granted by the Federal Energy and Regulatory Commission. That license places certain obligations on the power company to regulate uses along the shoreline and to develop a Shoreline Management Plan (SMP) to ensure the protection and enhancements for recreational, environmental, cultural and scenic purposes. It’s important to understand what the SMP means to you as a current or prospective property owner and how that impacts the development of your property as well as the investment value of your property. for this reason, it is critical that you work with an experienced lake real estate agent. There are many many details to deal with, however a few important things to understand are as follows.

- There are three important elevation contours and understanding where these are on your property is critical. 1.) The lake level at “full pond” is the 795′ elevation contour. 2.) The “Project Zone” is the 800′ elevation contour and it is the level to which, the power company has the right to flood the lake, if necessary, and it is also the elevation below which, the power company regulates all construction, including docks as well as vegetation removal. The 802.7′ contour is the flood level of the lake. if any portion of your home is built below that level and you have a mortgage, flood insurance will be required. Keep in mind that the distance from the water’s edge to the 800′ and 802.7′ contour depends on the height of the shoreline lip as well as the slope of the lot. On a flat lot with a small lip they will extend well into what you consider your “back yard”.

- The SMP specifies the parameters of all dock construction. For example, the maximum square footage of a dock is dictated by a number of factors, not the least of which, is the linear footage of shoreline that the lot has at the 795 contour. The first step in building or modifying any dock is to obtain a dock permit from the power company. This requires a survey of the shoreline, which must include an accurate drawing of the new dock or modified dock design. If the linear shoreline is between 100 and 300 feet, a 1500 square foot dock size is permissible, however other factors can come into play such as the location of neighboring docks.

Download the Shoreline Management Plan

Check Current SML Lake Level

Property Tax Rates at SML

Bedford County tax Rate

$0.41 per $100 of assessed value. First half payable June 5th and Second half payable December 5th.

Example: For $575,000 assessed value. $575,000/100*.41=$2,357.50 per year.

Franklin County tax Rate

$0.43 per $100 of assessed value. First half payable June 5th and Second half payable December 5th.

Example: For $575,000 assessed value. $575,000/100*.43=$2,473 per year.

Pittsylvania County tax Rate

$0.56 per $100 of assessed value. First half payable June 10th and Second half payable December 10th.

Example: For $575,000 assessed value. $575,000/100*.56=$3,220 per year.